Last week, the index of non-ferrous metals continued since May weak pattern, fell 0.97%. Composition of the overall decline in copper, aluminum, zinc, lead, respectively, fell by 1.07%, 2.45%, 3.09% and 1.65%.

International, European economic data was mixed, but the overall positive. The euro zone in July PMI was revised to 52.4, although 52.5 in June fell slightly, but taking into account the June manufacturing sector expansion speed is the fastest in 14 months, July data remained satisfactory. In the United States, in July the number of non farm payrolls increased by 215000 people, although slightly less than expected, but it has been more than third people in 200000 consecutive months. At the same time, there is no sign of inflation; the Fed's interest rate hike has become a big probability event. If it is expected to continue to heat up, the dollar index may return to the top of the commodity price will be under pressure.

Domestic, the demand for the two quarter continued downturn. PMI7 end of the month fell to 47.8, and refresh the two-year low. Steady growth policy effect is not as obvious as expected, if there is no further stimulus policies, the demand side will be difficult to improve. In the short term, the index continued to decline in the probability of a large.

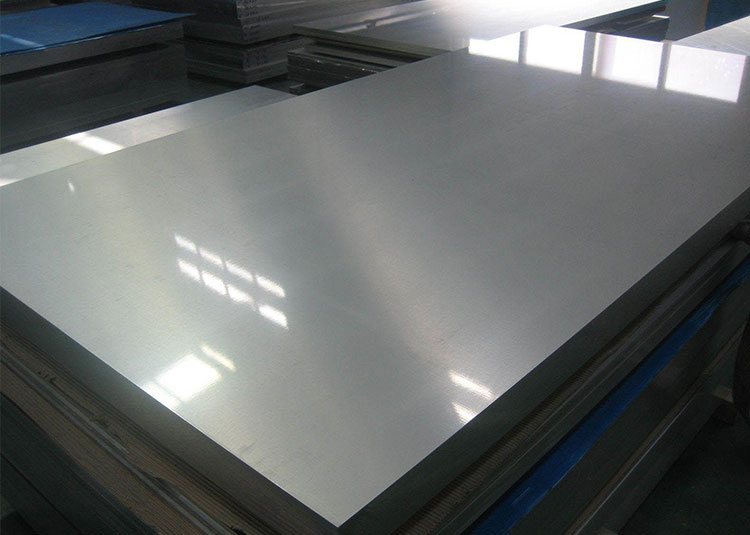

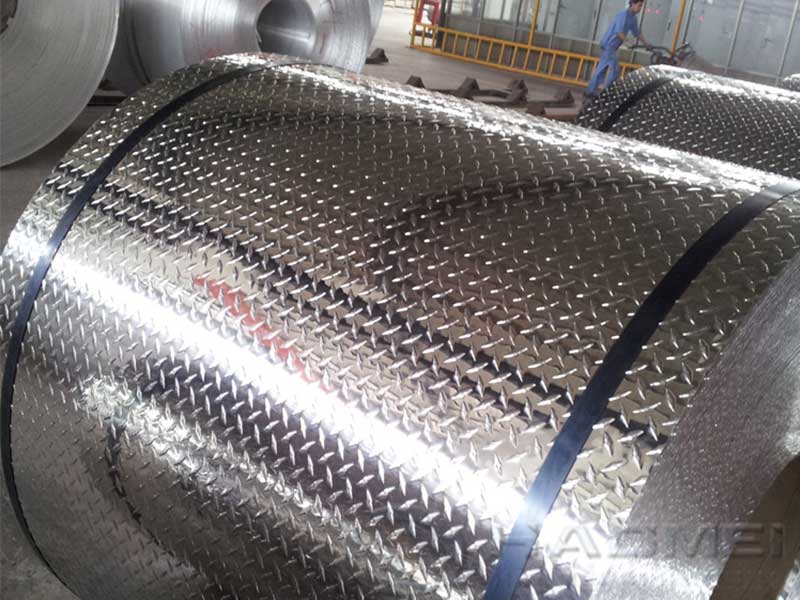

Aluminum: spot, although aluminum continued to decline, making aluminum and traders reluctant to sell emotions increased, but did not therefore stimulate downstream orders, stock turnover is still relatively light. In the futures market, the short atmosphere still holds the upper hand, but the decline in the expected decline in aluminum. Is expected to continue the pattern of aluminum will continue to fall.

International, European economic data was mixed, but the overall positive. The euro zone in July PMI was revised to 52.4, although 52.5 in June fell slightly, but taking into account the June manufacturing sector expansion speed is the fastest in 14 months, July data remained satisfactory. In the United States, in July the number of non farm payrolls increased by 215000 people, although slightly less than expected, but it has been more than third people in 200000 consecutive months. At the same time, there is no sign of inflation; the Fed's interest rate hike has become a big probability event. If it is expected to continue to heat up, the dollar index may return to the top of the commodity price will be under pressure.

Domestic, the demand for the two quarter continued downturn. PMI7 end of the month fell to 47.8, and refresh the two-year low. Steady growth policy effect is not as obvious as expected, if there is no further stimulus policies, the demand side will be difficult to improve. In the short term, the index continued to decline in the probability of a large.

Aluminum: spot, although aluminum continued to decline, making aluminum and traders reluctant to sell emotions increased, but did not therefore stimulate downstream orders, stock turnover is still relatively light. In the futures market, the short atmosphere still holds the upper hand, but the decline in the expected decline in aluminum. Is expected to continue the pattern of aluminum will continue to fall.