From June 1, 2022, until the end of 2023, Brazil's Ministry of Finance has reduced import tariffs by 10% on a variety of goods, including primary aluminum, aluminum sheets and aluminum cans. The new effective tariff for primary aluminium under HS code 7601.10.00 is 4.8%; aluminium sheet (7606.12.10 and 7606.12.90) is 9.6%; aluminium can (7612.90.19) is 12.8%. Primary aluminium imports are currently exempt from any tariffs, with a total quota of 350,000 tonnes until the end of 2022. About 80,000 tonnes of the quota had been consumed by the end of April, according to official data. Some Brazilian market participants believe that there will be no new duty-free quotas for primary aluminium imports in 2023 due to the resumption of production at the Alumar aluminium smelter (447,000 tonnes/year), which is currently in the ramp-up phase.

The demand for aluminum foil rolls in Europe increased by 5% in the first quarter, and the packaging industry contributed

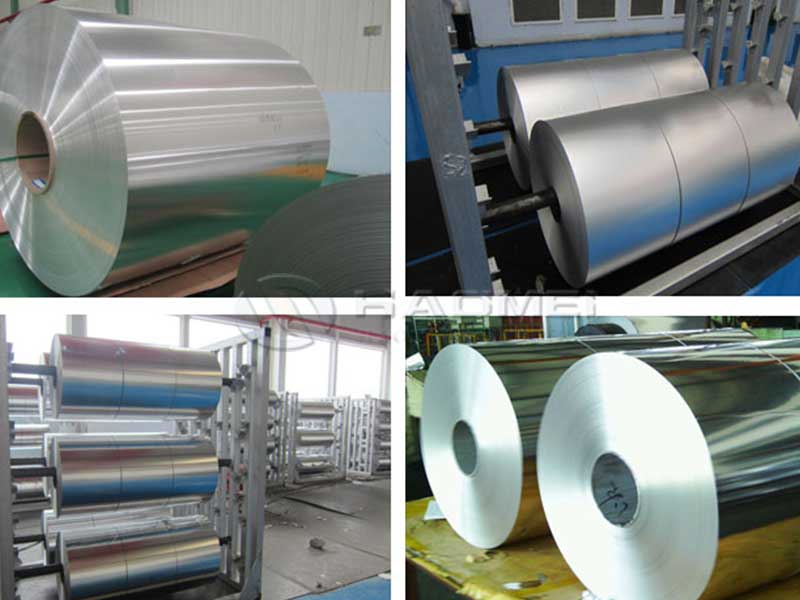

According to data released by the European Aluminium Foil Association (EAFA), in the first quarter of 2022, the steady growth in demand for aluminium foil coils in Europe offset the continued decline in exports. In the first quarter, European aluminum foil coil demand increased by 5%, exports plummeted 27%, and total production increased by 0.2% year-on-year to 244,700 tons.

Affected by the inventory trend of the new retail industry, the packaging industry has contributed greatly to the growth in demand for thin gauges. In the first quarter, European demand for thin-gauge aluminum foil (mainly used in flexible packaging and other kitchen packaging) increased by 9%, higher than the 6% growth rate in the previous quarter and the 3% growth rate for the whole of last year. Outside Europe, foil deliveries fell by around 25%. On the other hand, demand for thicker gauges for semi-rigid containers or other applications fell 1.5% in Europe and 30% outside Europe.