9th March 2017, the applicant Aluminum Association Trade Enforcement Working Group submitted an application to the US Department of Commerce for the requirements of the Chinese origin of aluminum foil anti-dumping and countervailing investigations, which also ask for as high as 134.33 % Of the anti - dumping duties for anti-dumping products.

Flowing are the related company: AlerisInc., AlphaAluminum, GoldenAluminum, GrangesAmericasInc., JWAluminumCompany, NovelisCorporation.

The applicant alleges that in 2016 US imports aluminum foil from China reached 30,3300 thousand pounds, occupys 70.6% of total US imports, an increase of 38.8% compared to 2014. This increase is much greater than US market growth, the price of aluminum foil products from China is much lower than the price of US producers, resulting in US manufacturers shipments market share and operating rate decline, revenue and profits also fell sharply, which has caused a certain impact on US industry.

According to statistics, China's aluminum foil prices to the United States is obviously lower than the price of other countries, from 2014 to 2016, China's aluminum foil import duty-paid prices for each pound was1.64USD, 1.57USD and 1.42USD, while the average price of aluminum foil imports in the same period is 2.49USD, 2.09USD, 1.8USD.

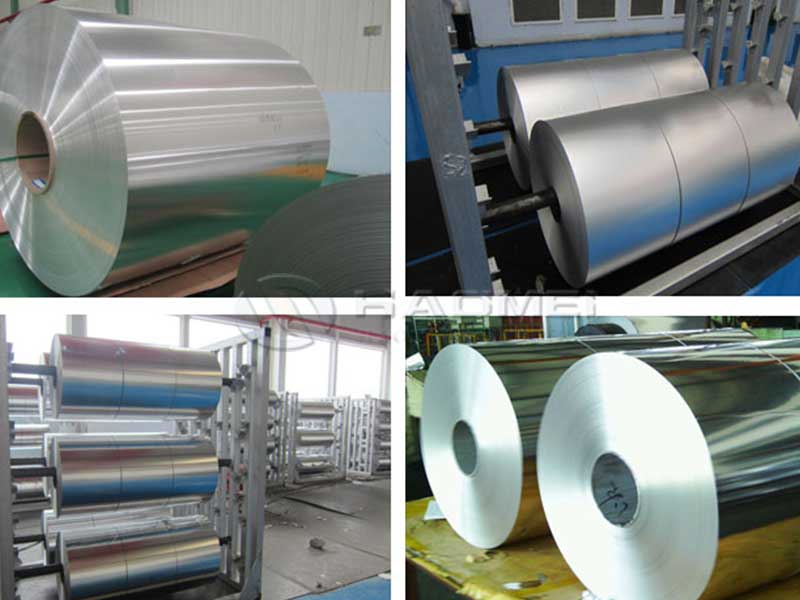

It is reported that the case involving the product is less than or equal to 0.2mm thickness of aluminum foil, roll and more than 25 pounds, no back and etching for the capacitor. Although the measurement method will be different, but as long as the use of nominal measurement or actual measurement of any one of the measurement methods to achieve the above criteria, the goods are involved . The product is located at customs number 7607.11.3000, 7607.11.6000, 7607.11.9030, 7607.11.9060, 7607.11.9090, and 7607.19.6000 (customs tariff number is for reference , the specific scope of the product to describe the subject).

The applicant alleges that in 2016 US imports aluminum foil from China reached 30,3300 thousand pounds, occupys 70.6% of total US imports, an increase of 38.8% compared to 2014. This increase is much greater than US market growth, the price of aluminum foil products from China is much lower than the price of US producers, resulting in US manufacturers shipments market share and operating rate decline, revenue and profits also fell sharply, which has caused a certain impact on US industry.

According to statistics, China's aluminum foil prices to the United States is obviously lower than the price of other countries, from 2014 to 2016, China's aluminum foil import duty-paid prices for each pound was1.64USD, 1.57USD and 1.42USD, while the average price of aluminum foil imports in the same period is 2.49USD, 2.09USD, 1.8USD.

It is reported that the case involving the product is less than or equal to 0.2mm thickness of aluminum foil, roll and more than 25 pounds, no back and etching for the capacitor. Although the measurement method will be different, but as long as the use of nominal measurement or actual measurement of any one of the measurement methods to achieve the above criteria, the goods are involved . The product is located at customs number 7607.11.3000, 7607.11.6000, 7607.11.9030, 7607.11.9060, 7607.11.9090, and 7607.19.6000 (customs tariff number is for reference , the specific scope of the product to describe the subject).